Technology

C3.ai Surges Amid Enterprise Software Downturn

Amid a challenging period for enterprise software firms, C3.ai (AI 21.61%) reported better-than-expected results for its April quarter on Wednesday. The company has shown accelerating revenue growth for five consecutive quarters, reaching 20% growth in the latest period for the first time since 2022. This performance boosted its stock by 17% on Thursday.

Contrasting Performances in the Sector

In stark contrast, Salesforce.com (CRM-20.81%) posted disappointing results on Wednesday, leading to a 20% drop in its stock on Thursday. UiPath (PATH-34.40%) saw a staggering 34% decline, while Workday also reported similarly poor quarterly results. These declines reflect a growing consensus that enterprise IT budgets are tightening, a trend affecting the entire sector.

What Sets C3.ai Apart?

C3.ai CEO Tom Siebel attributes the company’s success to its focus on AI applications. While budgets are tightening for conventional enterprise software, companies are spending liberally on AI applications. Siebel suggests that many established AI companies are struggling to adapt their legacy applications to the AI era.

“These companies have technology stacks that they built literally in the last century,” Siebel said in an interview with Barron’s. “They’ve just slapped an AI label on their products—ServiceNow, Salesforce, Workday, Oracle (ORCL-4.76%), SAP. I’m not convinced that approach works. The difference between us and them is that we’re native enterprise AI. I started building this AI software stack 15 years ago, and today we have 90 turnkey enterprise applications. We’re in a different league than they are.”

Siebel criticizes tech giants for superficial AI integration, touting his company’s native enterprise AI advantage, Barron’s Print Edition said.

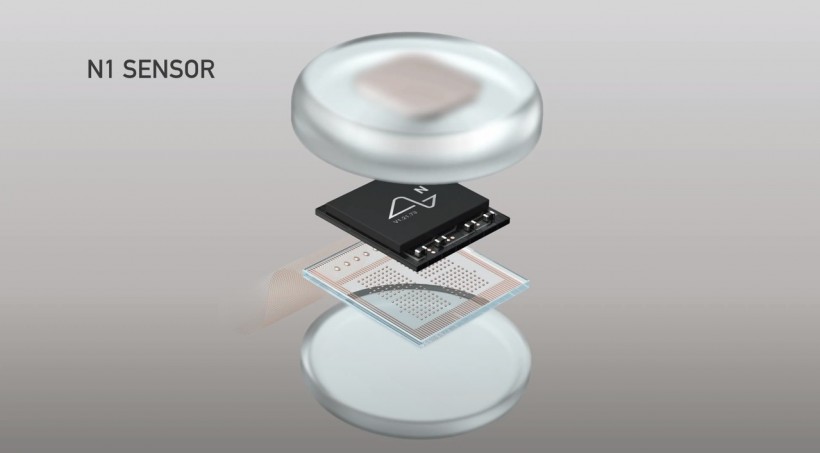

Neuralink Implants N1 Chip: Revolutionizing Neuroscience

Neuralink, Elon Musk’s company, implanted its advanced brain chip, “N1,” in a human for the first time, marking a significant milestone.

AI Spending Trends

Siebel suggests that AI could actually be a hindrance for some enterprise software companies as spending priorities shift. “It’s definitely not a hindrance for us,” he says. “Where we are, I’m not even sure there are any budgets. These companies just create the budgets as they go. This decision-making happens at the CEO level or the person in charge of manufacturing, and they don’t need a budget. Managers simply write a check and proceed.”

Siebel notes that all the chips Nvidia (NVDA-1.60%) is selling are being used to build out AI infrastructure to support AI applications. “These companies are creating hardware for us. They’re laying the groundwork far ahead of us so we can advance seamlessly.”

Lack of Innovation in Enterprise Software

The C3.ai chief, who also founded the customer relationship management software company Siebel Systems, which Oracle acquired in 2006, adds that enterprise software companies are suffering in part from a lack of innovation beyond AI.

“I mean, who doesn’t have CRM installed?” he asks. “Who doesn’t have an enterprise CRM license? Everyone has it. They need something new.”

Future Value in AI Ecosystem

Siebel argues that more of the value in the AI ecosystem will eventually accrue to AI software companies. “Let’s examine the AI stack,” he says. “At the bottom, we have silicon, and above that, we have infrastructure. Above that, we have foundational models, and on top of that, we have applications. Currently, the bulk of market value is attributed to silicon and infrastructure. It was the same in the PC market in 1990. But as we saw with PCs, in the long run, the value lies in the application layer, and that’s where we operate. Eventually, silicon becomes commoditized, as does infrastructure. We’ve seen this pattern before.”

Subscribe today to unlock the synergy of The Wall Street Journal Newspaper and Bloomberg Digital. Gain daily market insights, top stock picks, and rich content. Get 70% off with a 3-year all-digital subscription for seamless access across devices. Stay informed on finance, business, politics, and more. Elevate your financial comprehension now!